Open Battle Cases: Your Guide to Legal Insights

Explore the latest news and insights on legal battles and case studies.

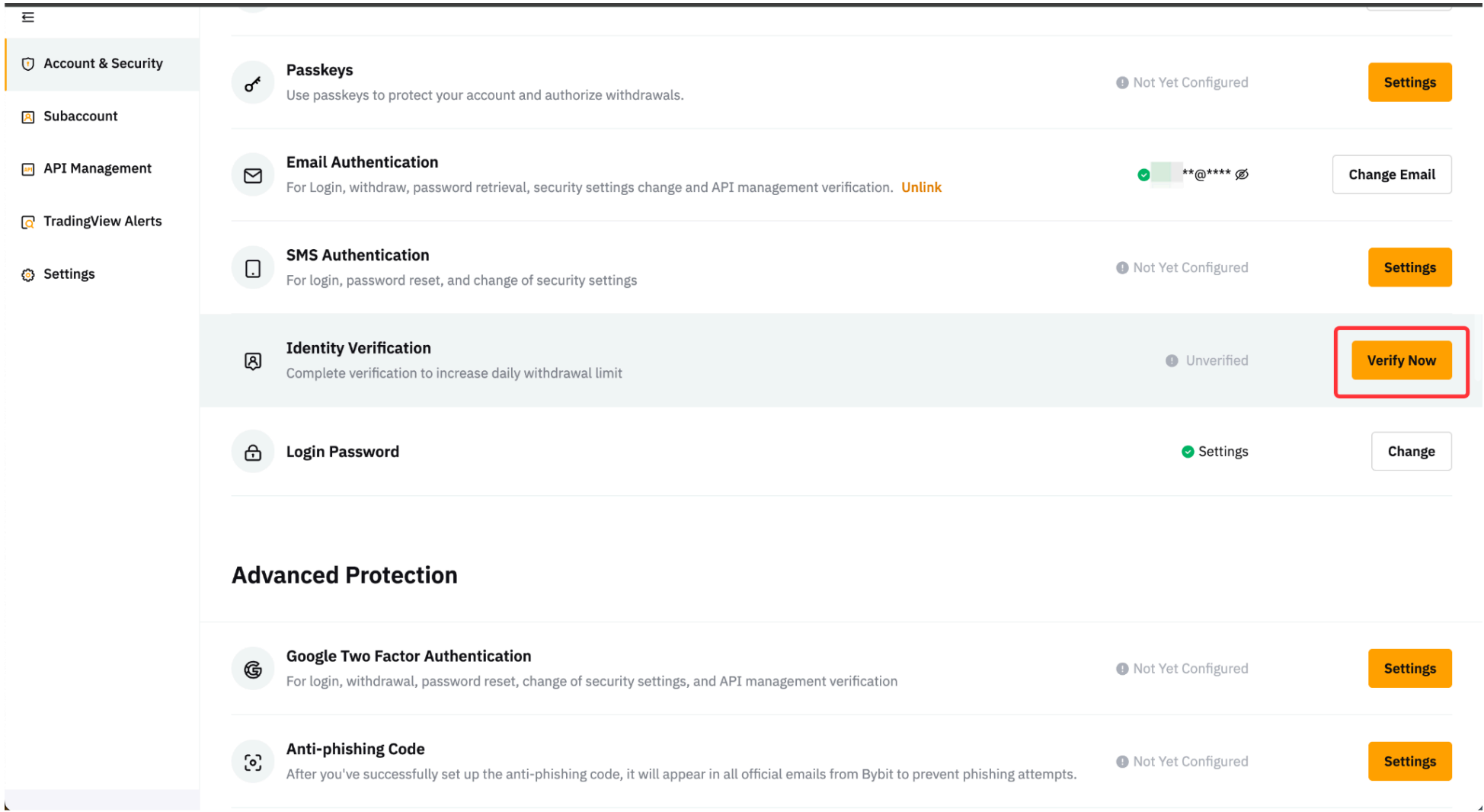

KYC Verification: The Secret Handshake for Easy Withdrawals

Unlock hassle-free withdrawals with our guide to KYC verification—discover the secret handshake everyone is talking about!

Understanding KYC Verification: Why It’s Essential for Smooth Withdrawals

KYC verification, or Know Your Customer, is a critical process implemented by financial institutions and platforms to confirm the identity of their clients. This procedure is pivotal for ensuring compliance with regulatory requirements, preventing fraud, and fostering a safe financial environment. Without proper KYC verification, customers may face significant delays or even rejections when attempting to make withdrawals from their accounts. By understanding the importance of KYC, clients can appreciate the measures taken to protect their funds and personal information.

In essence, KYC verification streamlines the withdrawal process by ensuring that all customers are verified and trustworthy. When a user has successfully completed KYC, they can expect a smoother transaction experience, eliminating the risk of unnecessary complications. Furthermore, as regulatory demands increase globally, platforms that adhere to these standards not only secure their operations but also enhance customer confidence. Thus, understanding and completing KYC verification is essential for anyone looking to enjoy seamless and secure withdrawals from their accounts.

To take advantage of exciting offers, don't forget to use the rainbet promo code when signing up. This code may unlock special bonuses that enhance your gaming experience. Make sure to enter it during registration to get the most out of your time on the platform.

The Benefits of KYC Verification: Ensuring Your Security and Streamlining Transactions

KYC verification, or Know Your Customer verification, is an essential process for businesses, particularly in the financial sector. This practice enhances security by verifying the identities of customers, which significantly reduces the risk of fraud and money laundering. By implementing KYC protocols, companies can ensure that they are not inadvertently engaging with individuals involved in illegal activities. Consequently, this fosters a safer environment for all stakeholders, including customers and employees, as it establishes a level of trust that is critical in today’s digital age.

In addition to enhancing security, KYC verification also plays a crucial role in streamlining transactions. When customer identities are verified, transactions can be processed more quickly and efficiently, minimizing delays. This leads to an improved customer experience, as clients can complete their financial activities without unnecessary hindrances. Moreover, with enhanced regulatory compliance thanks to KYC, businesses can avoid hefty fines and legal repercussions, making KYC verification not only a security measure but a vital component of operational efficiency.

Common Questions About KYC Verification: What You Need to Know for Hassle-Free Withdrawals

KYC, or Know Your Customer, verification is a crucial process for financial institutions and businesses to ensure that they are engaging with legitimate users. The significance of KYC can't be overstated, especially when it comes to hassle-free withdrawals from your accounts. Oftentimes, users have common questions about this verification process. For instance, one might wonder: What documents are required for KYC? Generally, a government-issued ID, proof of address, and sometimes additional documentation are needed. By being prepared with the necessary documents, you can speed up the KYC verification process and subsequently your withdrawals.

Another frequent query revolves around how long does KYC verification take? While the time varies by institution, most reputable platforms aim to complete the verification process within a few hours to a couple of days. It's essential to note that delays can occur, particularly if the submitted documents are unclear or insufficient. To avoid any unwanted hold-ups, double-check the quality and validity of your documents before submission. By understanding these common questions about KYC verification, you not only enhance your knowledge but also pave the way for a smoother withdrawal experience.